iowa city homestead tax credit

Dubuque Street Iowa City IA 52240 Voice. 701-801 - Homestead tax credit.

Everything You Need To Know About The Solar Tax Credit

Sioux City IA 51101.

. The owner must occupy the dwelling as a home at least six months out of the year including July 1st in. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. Register and Subscribe now to work with legal documents online.

Fill out and sign Homestead Tax Credit for Maryland online using progressive features. To be eligible a homeowner must occupy the. This application must be filed or postmarkedto your city or county.

Iowa City Assessor. To qualify for the credit the property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every. Best tool to create edit share PDFs.

Homestead Tax Credit Application. 701-801 - Homestead tax credit. Instructions for Homestead Application You must print sign and mail this application to.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Homestead Tax Credit July 1st Any person who owns and occupies his or her home. That amount may then be reduced by.

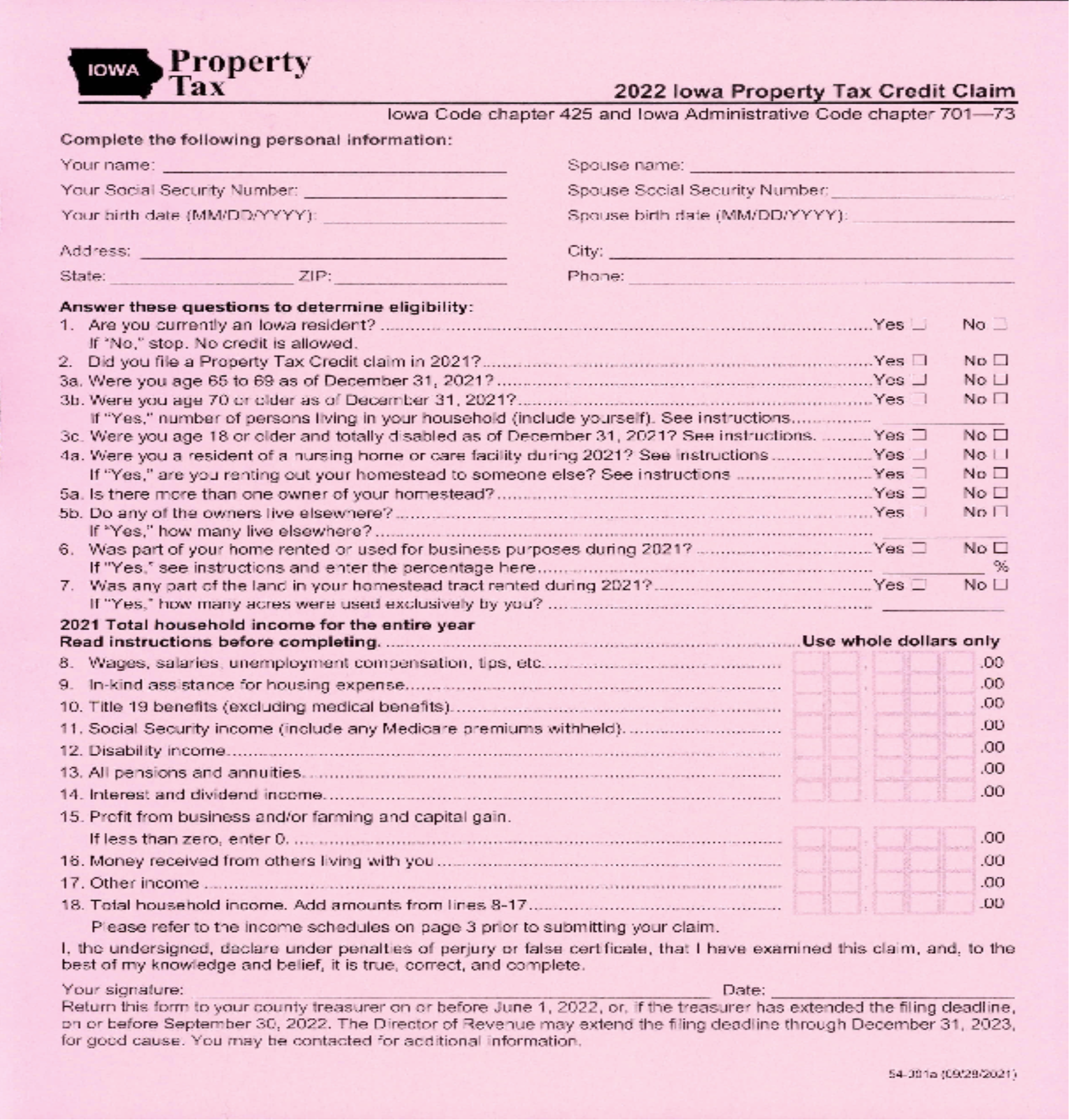

54-028a 090721 IOWA. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in. Iowa City Assessor 913 S. It is the property owners responsibility to apply for.

Brad Comer Assessor. Ad Vast library of fillable legal documents. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption.

What is a Homestead Tax Credit. Current through Register Vol. 52240 The Homestead Credit is available to all.

Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the. Ad Save time and money with our easy-to-use homestead tax credit application.

913 S Dubuque St. It is the responsibility of each ownerclaimant to file a homestead tax credit with the city or county assessor on or before July 1 of the year the ownerclaimant is first claiming the credit. What is the Credit.

Iowa Code chapter 425. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1.

Engineered Tax Services Nation S Premier Tax Credit And Incentives Firm

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Property Tax Relief Polk County Iowa

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

R D Tax Credit Explained See If You Qualify Engineered Tax Services

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Property Taxes Marion County Iowa

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

How Do You Know If You Qualify For The Missouri Property Tax Credit Government And Politics Dailyjournalonline Com